Unlocking the Tax Benefits of Owning a Historic Home in South Carolina

Unlocking the Tax Benefits of Owning a Historic Home in South Carolina

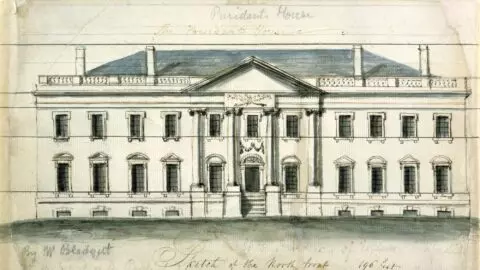

There’s something magical about living in a historic home—the creak of old hardwood floors, the intricate moldings, the stories whispered by the walls. But beyond the charm, did you know that owning a historic home in South Carolina can open the door to some serious tax benefits? Whether you’re a homeowner, a potential buyer, or a real estate investor, understanding these incentives can make your preservation dreams even sweeter.

Why Historic Homes Get Special Treatment

Preserving history isn’t just about nostalgia—it’s about protecting the character and culture of our communities. South Carolina, with its rich heritage, encourages homeowners to maintain and restore historic properties through a variety of tax incentives. And if your home qualifies, you could save thousands of dollars while safeguarding a piece of the past.

Key Tax Benefits for Historic Homeowners

- Federal Historic Preservation Tax Credit (HTC): While this program is primarily for income-producing properties, homeowners who rent out their historic residences or operate a bed and breakfast may qualify for a 20% tax credit on qualified rehabilitation expenses. Learn more & apply.

- South Carolina State Historic Rehabilitation Tax Credit: South Carolina offers a 25% state income tax credit for certified rehabilitation of owner-occupied historic homes. That’s a big deal for anyone restoring an old beauty! See the rules & application.

- Bailey Bill Property Tax Assessment: Many South Carolina municipalities offer a special property tax assessment (often called the Bailey Bill) that can freeze your property tax value for up to 20 years after approved renovations. This means your improvements won’t hike your tax bill. Check eligibility & details.

Tips for Maximizing Your Tax Benefits

- Start with Certification: Make sure your home is listed on the National Register of Historic Places or is in a designated historic district. Find out here.

- Plan Before You Renovate: Work closely with your local historic preservation office. You’ll need to get rehab plans approved to qualify for most credits.

- Keep Detailed Records: Save every receipt, photo, and document related to your renovation. The more thorough your documentation, the smoother your application process will be.

- Consult the Experts: Reach out to a tax advisor or preservation consultant familiar with these programs. They can help you avoid pitfalls and maximize your savings.

Helpful Resources

- South Carolina Department of Archives & History: Tax Incentives

- National Park Service: Federal Tax Incentives

- IRS: About Form 3468 (Investment Credit)

Owning a historic home is a labor of love, but with the right knowledge and a little paperwork, it can also be a savvy financial move. So whether you’re restoring a grand Charleston mansion or a cozy craftsman cottage, don’t leave these tax benefits on the table—your wallet (and your home’s history) will thank you!

Categories

Recent Posts

GET MORE INFORMATION